Effects of VAT exemption abolition to imported low value consignments

22:00 18. 01. 2021 WIP

Contents

Problem definition

From 1. 7. 2021 EU Customs Codex has abolished the VAT (Value added tax) exemption limit on imported low-value goods (consignments below 22€). This means, that even for such small consignments, the VAT from the imported goods will have to be paid in the state of the consumption. The goods below 150€ will still be exempt from standard customs duties, unless the goods are subject to excise or such. The point of this simulation will be to estimate the tax revenue based on the VAT rate and COVID-19 situation in following years 2021 and 2022.

Method

For simulation of the problem, I chose method Monte Carlo in MS Excel.

Model

Input parameters

VAT rate in the Czech Republic

There are currently three VAT rates applied: 21% as a standard rate, 15% and 10%. The reduced rates can be used on several types of goods, but from those which can be imported within low value consignments, this applies mainly to printed goods, leaflets, books, newspaper and magazines, where advertisements do not exceed 50% of the content. In my simulation, I kept the three VAT rates as input parameters. The percentage of imported goods which are subject to one of the lowered rates are calculated as variables – more in Variables.

COVID-19 restrictions

COVID-19 restrictions is artificial parameter reflecting the average status of economic restrictions in the corresponding year. The accepted values are whole numbers between 0-10, where 0 = no restrictions and 10 = complete economy lockdown. For example for year 2020, this parameter would have value 3 – see following derivation:

January 0 February 0 March 4 April 6 May 4 June 2 July 1 August 1 September2 October 4 November 7 December 6 Average 3

VAT novel start date

Input parameter determining the start date of the VAT novel. This is included mainly due to the reason, that the date has already been deferred several times. Currently valid (also default) value is 15. 7. 2021.

Year

Year parameter determines the year for which the simulation will be done. Possible values are 2021 and 2022.

Variables

Excpected volume of low value consignments

Calculation of this variable has been done by analysis of data about international trade in years 2005-2020 and can be found on list Expected volume of LVC calc. The main input has been volume of imported low value consignments for each EU country (source European commission data; UPU, private and designated postal operators’ data and EY analysis). Following steps were taken to determine the probability distribution:

1. Amounts for each state were divided by the population, obtaining volumes of imported LVC per capita

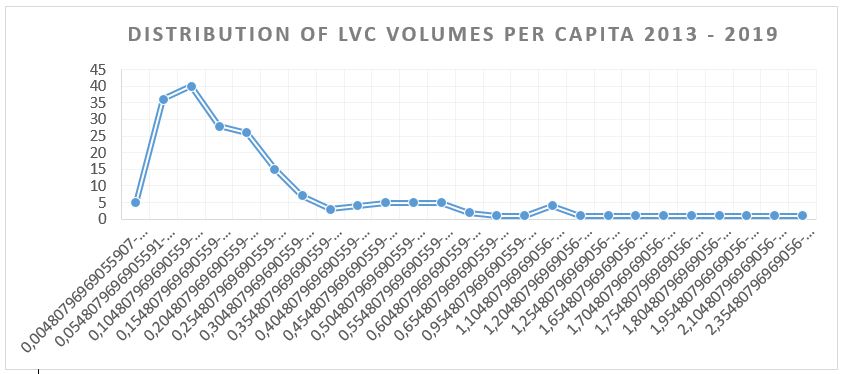

2. Values in the obtained dataset were grouped to ranges with increase 0,05 items per capita and distribution analysis was done. For the analysis, only values from years 2013-2019 were used – see more in chapter Assumptions. The year 2020 was excluded intentionally due to the COVID-19 pandemics influence

3. The graph of probability distribution suggested the normal distribution of the target variable

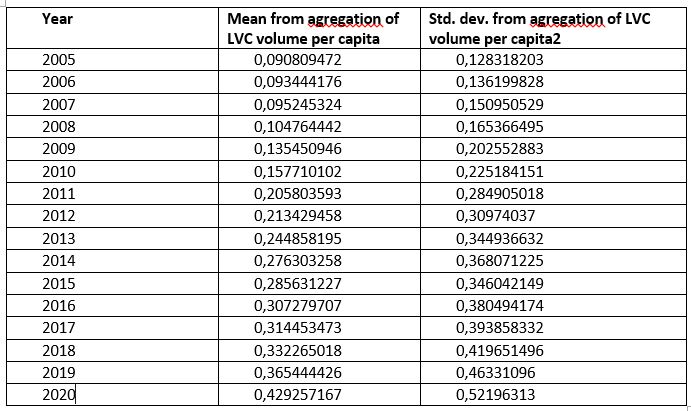

4. Mean and standard deviation were calculated from the dataset

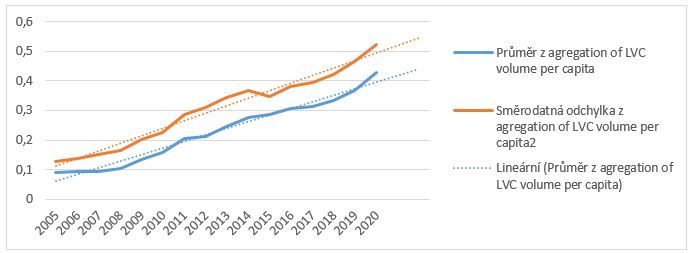

5. Calculated mean and standard deviation were put to graph

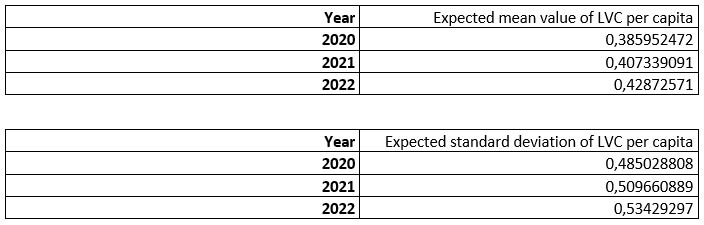

6. Using linear regression method, estimates were calculated for years 2020 (without COVID-19), 2021 and 2022

mean: y=0,021386619x -42,81501772

std. Dev.: y = 0,024632081x - 49,2717742

7. By comparing the calculated expected mean value for year 2020 (0,385952472) and the actual value including impacts of COVID-19 pandemics (0,429257167), a constant for pandemics influence was determined: 0,014434898

Distribution of VAT rates

As mentioned previously, Czech Republic currently applies three different VAT rates. For determination of distribution of the applied rates to imported low value goods, I used following steps (can be found on list Different VAT rate distribution):

1. I determined specific goods categories, which can be imported on LVC and are subject to one of the lower rates

a. First reduced rate: classification code 4901 – Printed books, brochures, leaflets and similar printed matter, whether or not in single sheet

b. Second reduced rate: classification codes 4902 – Newspapers, journals and periodicals, whether or not illustrated or containing advertising material; 4903 – Children’s picture, drawing or colouring books; 4909 – Printed or illustrated postcards, printed cards bearing personal greetings, messages or announcements

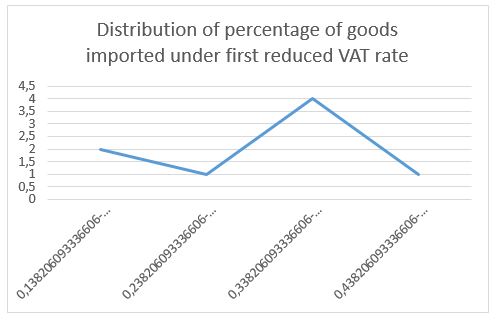

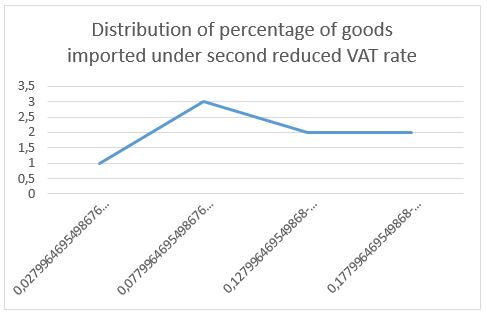

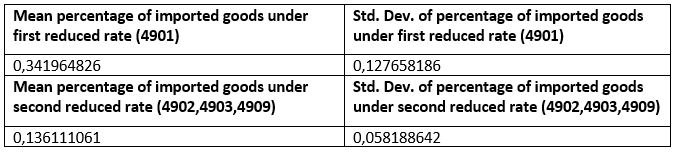

2. I analysed the amount of imported consignments classified as one of the above mentioned and by similar method, determined the probability distribution of both reduced VAT rates

3. Due to general lack of data, both distributions were classified as normal

4. Mean and standard deviation was calculated for both variables

Low value consignment invoice value

Low value consignments invoice value in Czech Republic can be up to 22€ (~ 524 CZK). As there are no available data about this indicator, in the simulation I used random variable with values between 10€ (~ 262 CZK) and 22€ (~524 CZK)

Low value consignment transport costs

In Czech Republic (in contrary with other EU states), transport costs are not included in the 22€ threshold for low value goods. Again, I did not find any relevant data indicating standard transport costs for LVC in the Czech Republic, therefore based on my own experience, I determined this as a random variable with values between 3€ (~ 78 CZK) and 7€ (~ 183 CZK).

Assumptions for the model

- The calculation abstracts from the population growth in past years: current population statistics were used

- The distribution analysis of LVC volumes abstracts from the growth of imported low value goods between years 2013-2019.

- The currency rate between EUR and CZK is determined in the date of the simulation and does not reflect any further or previous oscillations

Simulation

The main goal of the simulation was to determine possible expected profit on levied VAT. For the mentioned following steps were taken:

1) Using the data obtained in previous analysis, variable “Expected volume of LVC” is calculated for the selected year (probability of the normal distribution was set to random number between 0,5 and 0,99)

2) Using the calculated constant for pandemics influence and inputted parameter for the restrictions, the expected volume of LVC is multiplied correspondingly

3) Using the data obtained in previous analysis, variables “Expected volume of LVC under first reduced VAT rate” and “Expected volume of LVC under second reduced rate” are calculated (Expected volume of LVC including pandemics restrictions multiplied by calculated probability of the reduced rates)

4) Variable “Expected volume of LVC under standard VAT rate” is calculated as “Expected volume of LVC including pandemics restrictions” – “Expected volume of LVC under first reduced VAT rate” – “Expected volume of LVC under second reduced VAT rate”

5) The amount of applicable days is calculated based on inputted VAT novel start date and target year

6) The final expected profit on levied VAT is calculated as a sum of three values (one per one VAT rate): expected volume of LVC under corresponding VAT rate multiplied by expected average value multiplied by corresponding VAT rate and recalculated per the number of applicable days.

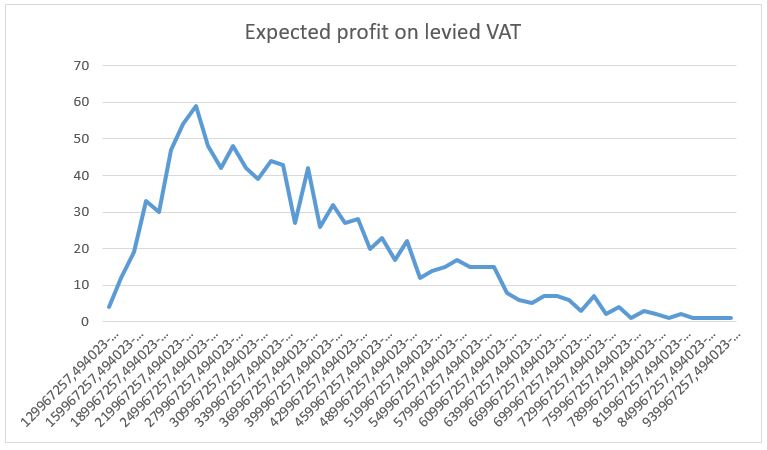

7) The simulation is then run 1000 times

Results

The simulation was run several times for different scenarios – mainly with the change in pandemics restrictions.

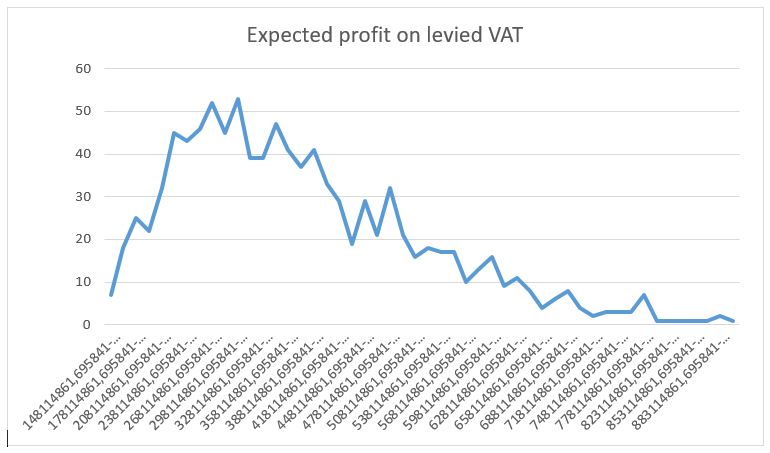

Standard VAT rates, no pandemics restrictions, VAT novel start date as expected

Input parameters:

- VAT rates: 21%, 15%, 10%

- Pandemics restrictions: 0

- VAT novel start date: 15. 7. 2021

In this scenario, the mean value for the profit on levied VAT is 363 608 893,56 CZK. The values oscillated the most between 230 mil. CZK and 370 mil. CZK.

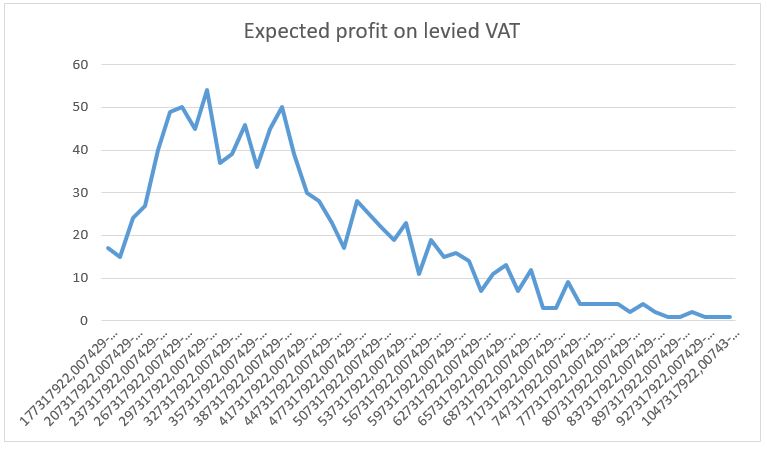

Standard VAT rates, pandemics restrictions similar to year 2020, VAT novel start date as expected

Input parameters:

- VAT rates: 21%, 15%, 10%

- Pandemics restrictions: 3

- VAT novel start date: 15. 7. 2021

In this scenario, the mean value for the profit on levied VAT is 387 090 878,55 CZK. The values oscillated the most between 211 mil. CZK and 360 mil. CZK.

Standard VAT rates, significantly stronger pandemics restrictions, VAT novel start date as expected

Input parameters:

- VAT rates: 21%, 15%, 10%

- Pandemics restrictions: 7

- VAT novel start date: 15. 7. 2021

In this scenario, the mean value for the profit on levied VAT is 408 066 744,31 CZK. The values oscillated the most between 250 mil. CZK and 420 mil. CZK.

Conclusion

The simulation offered quite simple and clear results on the relationship between the pandemics restrictions and the amount of imported low value goods – mainly by individuals. This can be explained probably mainly by the increased amount of time spent at home and by the restrictions of local economy – instead of going to local shop, most people rather order goods online.

The expected profit from the LVC for year 2021 fluctuated approximately between 300 mil. CZK and 400 mil. CZK. It is said, that in year 2020, Czech government levied over 1 billion CZK, where appx. 413 milliards CZK were from VAT. This means, that the profit from the LVC novel – even if we would take into account the highest results - will take quite small part in the government tax incomes. The data suggests, that in year 2020, the economic restrictions have cost the Czech government about 1 billion CZK. This results in fact, that even though the tax income from such consignments is slightly increased by the restrictions, it is still such a small difference that it is not even worth considering with comparison to the damage the restrictions cause to the economics.