Difference between revisions of "Development of real estate prices in Prague"

(→Natality) |

(→Variables) |

||

| Line 56: | Line 56: | ||

===Price of real estates decrease=== | ===Price of real estates decrease=== | ||

| − | Mortages rates | + | |

| + | ===Mortages rates=== | ||

Fio bank with 5 year of fixation - '''1,68 %'''. This value was set in simulation. | Fio bank with 5 year of fixation - '''1,68 %'''. This value was set in simulation. | ||

[https://www.hypoindex.cz/clanky/aktualni-sazby-hypotek-skupina-csob-zlevnuje-hypoteky/] | [https://www.hypoindex.cz/clanky/aktualni-sazby-hypotek-skupina-csob-zlevnuje-hypoteky/] | ||

| − | |||

| − | Lack of flats | + | ===Quantitative easing=== |

| + | The government's intervention will increase inflation very noticeably, especially in times of pandemic. Therefore, its value is set to 0.31 | ||

| + | |||

| + | |||

| + | ===Lack of flats=== | ||

| + | Lack of flats increases their prices. The significance coefficient is set to 0.9. | ||

| + | |||

| + | ===Abundance of flats=== | ||

| + | |||

| + | An abundance of flats decreases interest in flats increases their price. The coefficient factor is set to '''0.2'''. | ||

| − | + | ===Investors=== | |

| − | Investors | + | Investors' interest in flats increases their price. The coefficient factor is set to '''0.55''' |

=Results= | =Results= | ||

Revision as of 22:05, 20 January 2021

In progress

Name: Development of real estate prices in Prague

Author: Petr Netolický, netp02, 19.1.2021

Used tool: Vensim PLE 8.2.0

Contents

- 1 Problem definition

- 2 Method

- 3 Model

- 4 Variables

- 4.1 Population

- 4.2 Mortality

- 4.3 Natality

- 4.4 Emigration

- 4.5 Imigration

- 4.6 Population increase

- 4.7 Population decrease

- 4.8 Unemployment rate

- 4.9 Inflantion

- 4.10 GDP of Czech republic

- 4.11 Price of real estates

- 4.12 Price of real estates growth

- 4.13 Price of real estates decrease

- 4.14 Mortages rates

- 4.15 Quantitative easing

- 4.16 Lack of flats

- 4.17 Abundance of flats

- 4.18 Investors

- 5 Results

- 6 Conclusion

- 7 Reference

Problem definition

Every year, the price of real estate in Prague increases rapidly. As a result, young families can no longer afford to buy an apartment in the center of Prague, including a mortgage, and have to move to more educated villages and towns around Prague. The purpose of this simulation is to show trends and development of prices for flats, houses, and other real estates in Prague for next ten years based on real historical data available on the Czech statistical office. The aspectes which are taken into count are the influence of the investors, mortgage rates, population, lack of flats and others.

Method

The Vensim tool is used to simulate the problem. In this tool, it is possible to simulate the development of real estate in Prague over the next ten years.

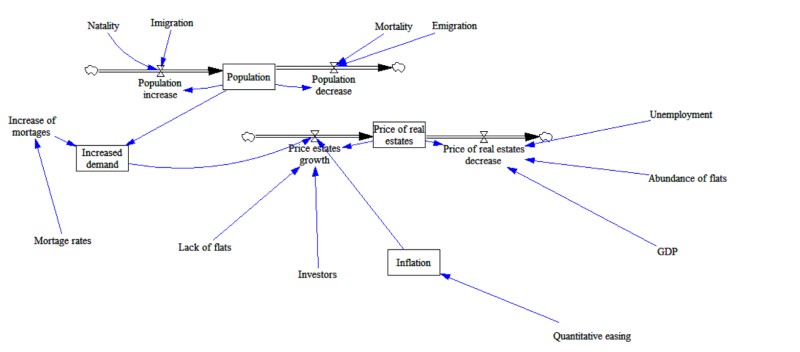

Model

Variables

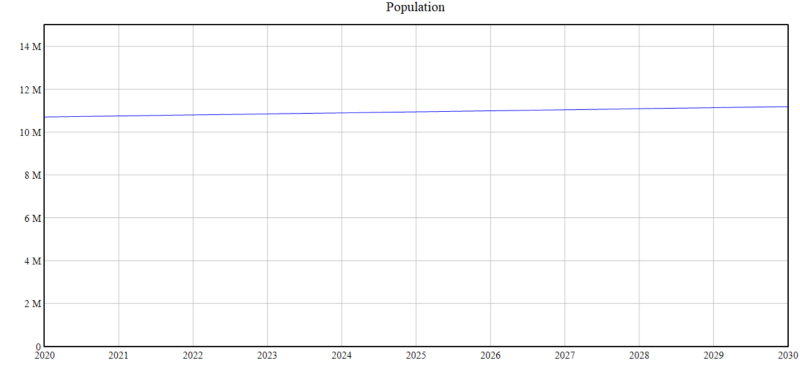

Population

Population of the Czech Republic. This is a data from September 30, 2020, initial value 10 707 839 [1]

Mortality

Initial value is based on data from Czech statistical office and it is set to 0,0105. [2]

Natality

Initial value is based on data from Czech statistical office and it is set to 0,0105.[3]

Emigration

This rate was calculated as emigrants / population. That is 21 300/10 707 839 = 0,002. [4]

Imigration

This rate was calculated as immigrants / population. That is 65 600/10 707 839 = 0,006. [5]

Population increase

Population growth in the Czech Republic. Calculated over the equation: Natality * Population * Immigration

Population decrease

Population decrease in the Czech Republic. Calculated over the equation: Mortality * Population * Emigration

Unemployment rate

Rate of unemployment people in Czech republic. It is in about 277 015 people, which is set to 0,038. [6]

Inflantion

The initial value of inflation was set on 0,03. [7]

GDP of Czech republic

Initial value is set to 0,95. [8]

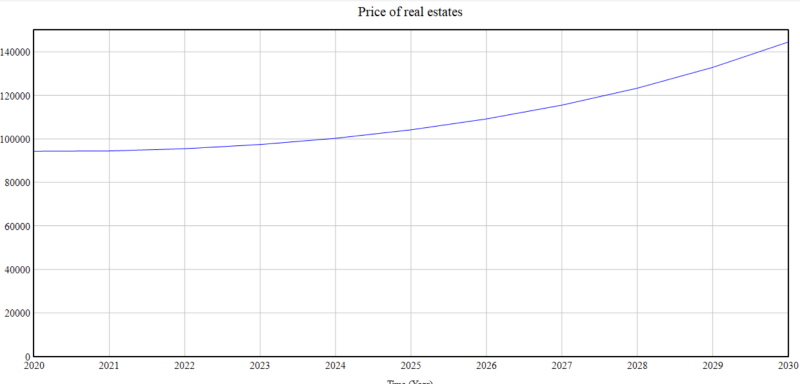

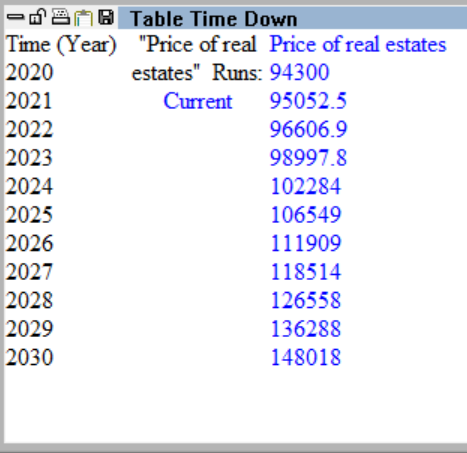

Price of real estates

Initial value is set on 94 300 kč/m2. [9]

Price of real estates growth

Price of real estates decrease

Mortages rates

Fio bank with 5 year of fixation - 1,68 %. This value was set in simulation. [10]

Quantitative easing

The government's intervention will increase inflation very noticeably, especially in times of pandemic. Therefore, its value is set to 0.31

Lack of flats

Lack of flats increases their prices. The significance coefficient is set to 0.9.

Abundance of flats

An abundance of flats decreases interest in flats increases their price. The coefficient factor is set to 0.2.

Investors

Investors' interest in flats increases their price. The coefficient factor is set to 0.55