Difference between revisions of "Shopping Centre Simulation"

(→Code) |

|||

| (2 intermediate revisions by the same user not shown) | |||

| Line 13: | Line 13: | ||

Costs=Leased sqm* "Costs/sqm" + Marketing costs | Costs=Leased sqm* "Costs/sqm" + Marketing costs | ||

| + | |||

Revenues = Leased sqm * "Rent/sqm" | Revenues = Leased sqm * "Rent/sqm" | ||

| + | |||

Rent loss = (Total sqm-Leased sqm)* "Rent/sqm" | Rent loss = (Total sqm-Leased sqm)* "Rent/sqm" | ||

| + | |||

New tenants per month = Marketing costs/Cost of acquisition)*Allotted unit size | New tenants per month = Marketing costs/Cost of acquisition)*Allotted unit size | ||

| + | |||

Leased sqm = new tenants per month-leaving tenants per month*Allotted unit size | Leased sqm = new tenants per month-leaving tenants per month*Allotted unit size | ||

| + | |||

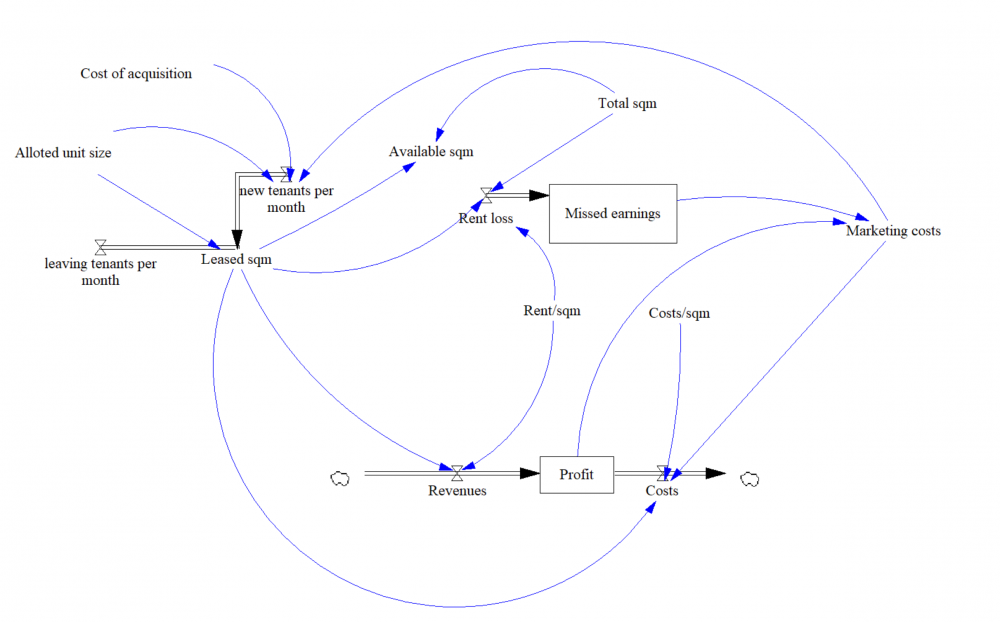

Stock and flow diagram: | Stock and flow diagram: | ||

| Line 23: | Line 28: | ||

=Results= | =Results= | ||

| − | We were able to get to some real interesting results. We were analysing a shopping centre of 50 000 sqm total with about half of the GLA leased. We wanted to quantify and simulate the marketing investment needed to fully lease the shopping centre and minimize rent loss. Here is the projected Profit into three years | + | We were able to get to some real interesting results. We were analysing a shopping centre of 50 000 sqm total with about half of the GLA leased. We wanted to quantify and simulate the marketing investment needed to fully lease the shopping centre and minimize rent loss. Here is the projected cumulated Profit into three years: |

| + | [[File:Profit.png|1000px]] | ||

| + | Red line shows the cumulated profit with small investment, blue one with large investment, green one with no investment. As we can see, some investment is better than none, but riskier. However, more investment does not mean quicker nor higher return in this case. | ||

=Conclusion= | =Conclusion= | ||

| + | Although there are many insufficiencies with the model right now, we are able to come to reasonable modelling of reality and using abstraction and simulated events to predict the future even with this state of the model. For future development it is necessary to fix the Leased sqm calculation, as it currently does not take into account the length of lease agreements. Also, the footfall of the centre hugely affects the attractiveness, therefore reducing the costs associated with getting new tenants. Amount of turnovers the retailers are generating is in some shopping centres used as leverage to incorporate percentage rent into the equation. It is not the case for this shopping centre, but it could be a point for further development of this model. These are just few ideas for improvement. | ||

=Code= | =Code= | ||

| + | [[File:Simulation_SCmanager.mdl]] | ||

Latest revision as of 02:46, 21 January 2020

Introduction

I will try to simulate events and causalities of shopping centre management. When it comes to managing a shopping centre, most of the work is operative. Servicing, maintaining, negotiating leases. However, there is an important decision-making aspect linked to the choice of tenant mix (Optimal composition of tenants). I have worked for a few companies that manage shopping cetres and this simulation was created in cooperation with one particular shopping centre that did not wish to be named. In creation of the model, we used real data. The data cannot be used for demonstration purposes, therefore I have extracted publicly available data about shopping centres from ICSC.com and Eurostat and I will be demonstrating the model on an average medium-sized European shopping centre. All parameters are to be tweaked according to regional statistics and past experience on the particular real estate market.

Problem definition

Simulate the long term effects of choosing one tenant over another, predict profits for better planning purposes.

Method

Originally, I wanted to use the Monte Carlo method, but together with Mr. Svatoš we came to conclusion that Vensim will be more suitable for this, as there are many parameters that can be adjusted and the benefits of repeating random outcomes are not that tangible in this particular problem. Using stock and flow diagram I will try to grasp the interrelationships that are at work during a shopping centre economic cycle.

Model

Main parameter of the model is Costs/sqm which evaluates the costs of heating, lighting and all fixed costs calculated per square meter. According to the costs you specify your rent/sqm. We are generalizing all charges into one variable Rent/sqm. Additionally, we specify Marketing costs, which are used to bring new people into the shopping centre, which in turn increases its attractiveness, making retailers more likely to open a branch. This specific centre has a policy, that 20% of profits will go to marketing. Also, if there was a rent loss last month (lost rent due to unoccupied space), they increase their marketing budget by an additional 20% of the Missed earnings. The rate of which our marketing expenditures are effective in bringing new tenants in is expressed by Cost of acquisition. This shows how much we have to spend in order to bring a new tenant to the centre. Coupled with allotted unit size, which indicates how is the leasing area of the shopping centre divided, derives the rate of which new tenants open their branches each month. The rate of which the tenants leave the shopping centre is used as a static variable. The difference between square meters gained by new tenants and square meters lost by tenants leaving is Leased sqm. The total gross leasing area of a centre is adjusted by the variable Total sqm. Profit is calculated as Revenues-Costs

Costs=Leased sqm* "Costs/sqm" + Marketing costs

Revenues = Leased sqm * "Rent/sqm"

Rent loss = (Total sqm-Leased sqm)* "Rent/sqm"

New tenants per month = Marketing costs/Cost of acquisition)*Allotted unit size

Leased sqm = new tenants per month-leaving tenants per month*Allotted unit size

Stock and flow diagram:

Results

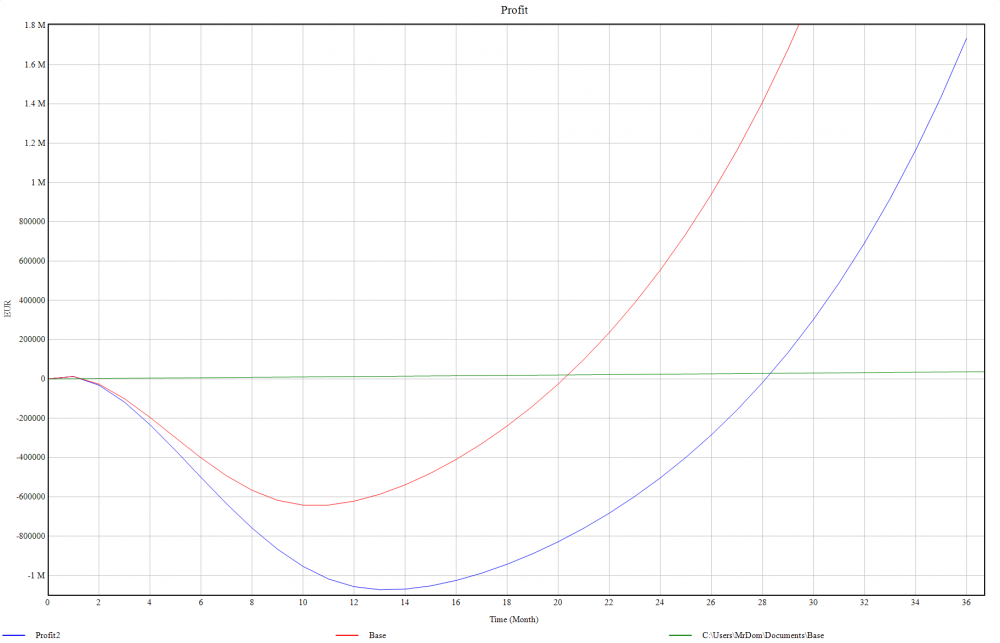

We were able to get to some real interesting results. We were analysing a shopping centre of 50 000 sqm total with about half of the GLA leased. We wanted to quantify and simulate the marketing investment needed to fully lease the shopping centre and minimize rent loss. Here is the projected cumulated Profit into three years:

Red line shows the cumulated profit with small investment, blue one with large investment, green one with no investment. As we can see, some investment is better than none, but riskier. However, more investment does not mean quicker nor higher return in this case.

Conclusion

Although there are many insufficiencies with the model right now, we are able to come to reasonable modelling of reality and using abstraction and simulated events to predict the future even with this state of the model. For future development it is necessary to fix the Leased sqm calculation, as it currently does not take into account the length of lease agreements. Also, the footfall of the centre hugely affects the attractiveness, therefore reducing the costs associated with getting new tenants. Amount of turnovers the retailers are generating is in some shopping centres used as leverage to incorporate percentage rent into the equation. It is not the case for this shopping centre, but it could be a point for further development of this model. These are just few ideas for improvement.