Difference between revisions of "Development of real estate prices in Prague"

(→Problem definition) |

(→Results) |

||

| Line 90: | Line 90: | ||

=Results= | =Results= | ||

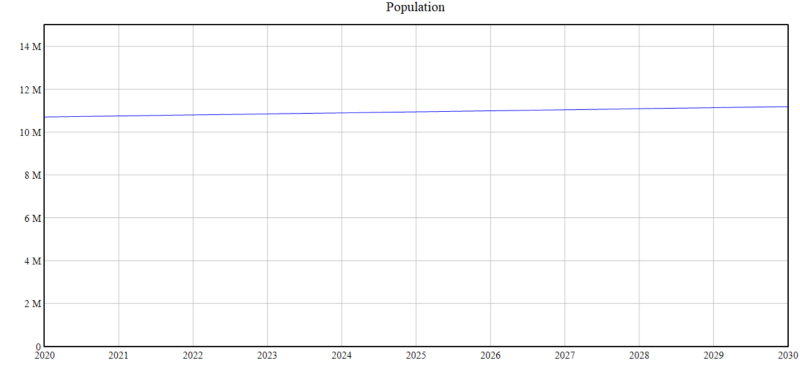

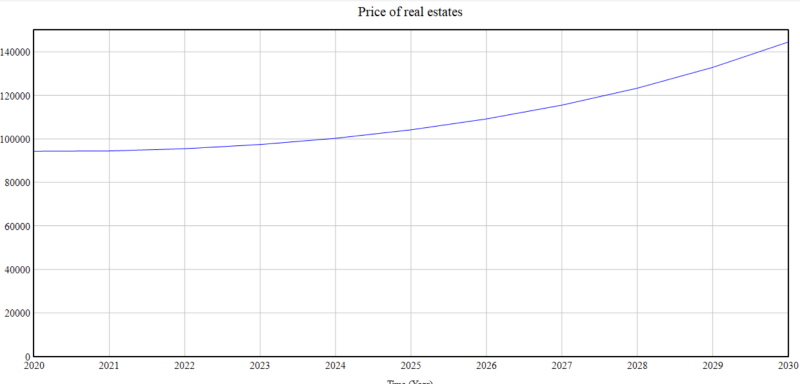

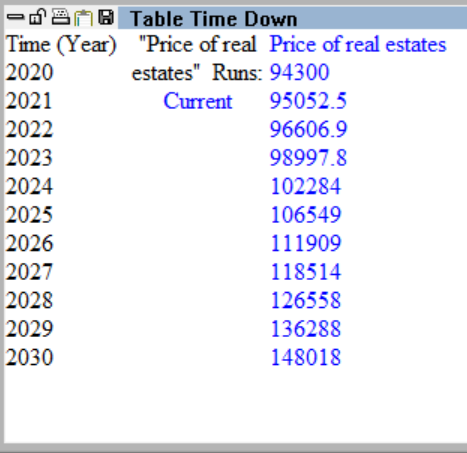

| + | To interpret the results, I chose two graphs and tables with specific data. The first graph shows the development of the population in the Czech Republic. This graph was not the subject of this work, but it is an interesting secondary output. The second graph and table describe the main purpose of this work, namely the development of real estate in the next ten years. That is, from 2020 to 2030. The graph and table show that according to this simulation and available data, the price per square meter in Prague will be 148,018 per year. Compared to the initial value from 2020, this is an increase of 57 %. | ||

[[File:Resultpopulation.jpg]] | [[File:Resultpopulation.jpg]] | ||

[[File:Resultgraph.jpg]] | [[File:Resultgraph.jpg]] | ||

Revision as of 22:46, 20 January 2021

In progress

Name: Development of real estate prices in Prague

Author: Petr Netolický, netp02, 19.1.2021

Used tool: Vensim PLE 8.2.0

Contents

- 1 Problem definition

- 2 Method

- 3 Model

- 4 Variables

- 4.1 Population

- 4.2 Mortality

- 4.3 Natality

- 4.4 Emigration

- 4.5 Imigration

- 4.6 Population increase

- 4.7 Population decrease

- 4.8 Unemployment rate

- 4.9 Inflantion

- 4.10 GDP of Czech republic

- 4.11 Mortages rates

- 4.12 Quantitative easing

- 4.13 Lack of flats

- 4.14 Abundance of flats

- 4.15 Investors

- 4.16 Price of real estates growth

- 4.17 Price of real estates decrease

- 4.18 Price of real estates

- 5 Results

- 6 Conclusion

- 7 Reference

- 8 Code

Problem definition

Every year, the price of real estate in Prague increases rapidly. As a result, young families can no longer afford to buy an apartment in the center of Prague, including a mortgage, and have to move to more educated villages and towns around Prague. The purpose of this simulation is to show trends and development of prices for flats, houses, and other real estates in Prague for next ten years based on real historical data available on the Czech statistical office. The aspects which are taken into count are the influence of the investors, mortgage rates, population, lack of flats, and others.

The picture shows the development of the price of flats in Prague from 2014 to 2020. The picture shows the development of the price of apartments in Prague from the beginning of 2014 to the end of 2020. During this time, the price of real estate has increased by an incredible 84 %.

Method

The Vensim tool is used to simulate the problem. In this tool, it is possible to simulate the development of real estate in Prague over the next ten years.

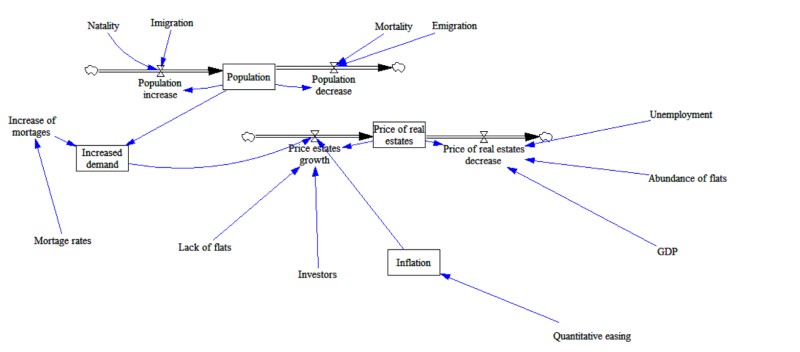

Model

The final picture of the model:

Variables

Population

Population of the Czech Republic. This is a data from September 30, 2020, initial value 10 707 839 [1]

Mortality

Initial value is based on data from Czech statistical office and it is set to 0,0105. [2]

Natality

Initial value is based on data from Czech statistical office and it is set to 0,0105.[3]

Emigration

This rate was calculated as emigrants / population. That is 21 300/10 707 839 = 0,002. [4]

Imigration

This rate was calculated as immigrants / population. That is 65 600/10 707 839 = 0,006. [5]

Population increase

Population growth in the Czech Republic. Calculated over the equation: Natality * Population * Immigration

Population decrease

Population decrease in the Czech Republic. Calculated over the equation: Mortality * Population * Emigration

Unemployment rate

Rate of unemployment people in Czech republic. It is in about 277 015 people. It is set to 0,038. [6]

Inflantion

The initial value of inflation was set on 0,03. [7]

GDP of Czech republic

Initial value is set as coeficient to 0,95. [8]

Mortages rates

Fio bank with 5 year of fixation - 1,68 %. This value was set in simulation. [9]

Quantitative easing

The government's intervention will increase inflation very noticeably, especially in times of pandemic. Therefore, its value is set to 0.31

Lack of flats

Lack of flats increases their prices. The significance coefficient is set to 0.9.

Abundance of flats

An abundance of flats decreases interest in flats increases their price. The coefficient factor is set to 0.2.

Investors

Investors' interest in flats increases their price. The coefficient factor is set to 0.55

Price of real estates growth

Factors that influence real estate growths Equation: (1+(Increased demand*Inflation*Investors*Lack of flats))*Price of real estates

Price of real estates decrease

Factors that influence real estate decrease Equation:(1+(Abundance of flats*GDP*Unemployment))*Price of real estates

Price of real estates

Equation: Price of real estates = Price estates growth - Price of real estates decrease Initial value is set on 94 300 kč/m2. [10]

Results

To interpret the results, I chose two graphs and tables with specific data. The first graph shows the development of the population in the Czech Republic. This graph was not the subject of this work, but it is an interesting secondary output. The second graph and table describe the main purpose of this work, namely the development of real estate in the next ten years. That is, from 2020 to 2030. The graph and table show that according to this simulation and available data, the price per square meter in Prague will be 148,018 per year. Compared to the initial value from 2020, this is an increase of 57 %.

Conclusion

Reference

- ↑ Deloitte real index Development of the selling price of flats from 2014 to 2020 [online]. [cit. 2021-01-20]. Recheable from: https://www2.deloitte.com/content/dam/Deloitte/cz/Documents/real-estate/CZ-Real-index_3Q_2020.pdf