Difference between revisions of "Widening the spread between rich and poor"

| (17 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

=Introduction= | =Introduction= | ||

| − | After global economic crisis in 2007-2009 traditional approaches for stimulating economy growth failed. As a consequence of this a new experimental approach was established, called ''Quantitative easing''. A lot of people think that it is just 'printing money' and putting it into economy. But this is wrong and very narrow minded. In fact, the central bank of particular country buys financial assets (mostly governement bonds) from banks in exchange for new money. The thought behind | + | After global economic crisis in 2007-2009 traditional approaches for stimulating economy growth failed. As a consequence of this a new experimental approach was established, called ''Quantitative easing''. A lot of people think that it is just 'printing money' and putting it into economy. But this is wrong and very narrow-minded. In fact, the central bank of particular country buys financial assets (mostly governement bonds and mortgage backed securities, in case of US bonds are US Treasuries, of different kinds and maturities, here we can find one difference from traditional expansionary policy, which aims on federal funds rates) from banks in exchange for new money. The thought behind quantitative easing is also pretty straightforward, however numbers say that it ceases to work. The first weakness of it is that the money is not put straight into economy (for example through government spending), but it is given to banks. Now when we are in low interest rates situation, it is not very rentable for banks to lend money to people, as with low interest rates and present inflation, they in fact get less value than they initially borrowed. So they often go and buy bonds and stocks themselves and thus overheat their prizes. And new money don't get into economy and so the growth of GDP is not promoted in a way, that it was thought. As 40% of stock market is owned by 5% of richest people in the world, it creates unequal distribution of wealth among population. Rich people get richer and poor people get even more poor and promotion of GDP growth stagnates. For example in the UK after quantitative easing of 375 billion pounds led to 1.2-2% growth of its domestic GDP, what is in numbers 23-28 bn pounds. So we can see how highly ineffective this is. |

=Model= | =Model= | ||

| + | |||

| + | For this simulation I will use US economy enviroment. In the second round of simulation, when banks will lend approximately 90% of new money, I will observe inflation rate variable, as it is suggested, that we did not face high level inflation (or maybe hyper-inflation) because banks did not lend majority of money they got. If they would have lend, it would be expected, that inflation would be much higher, as market demand for goods and services would be much higher and money supply would be also very high. When I simulate behavior of stock owner, I refer to those owners, who do not trade very often and speculate on the stock markets. I refer to those, who mostly have bigger share in companies and are somehow involved in companies and tend to hold their stocks in long term. | ||

| + | |||

| + | I start in year 2020. We can observe that quantitative easing takes place when interest rates reaches almost 0, but inflation is still very low, and there is threat of economy going into deflation spiral. After global crisis which ended in 2009, Fed used open market operations to lower interest rates, however it did not promote consumption and production enough to get US out of crisis (possibly because americans were already indebted enough and did not want to take new loans), this year there was also deflation of 0.36%. Fed then established quantitative easing, in order to promote spending and get USA out of deflation and out of crisis. As of 2020, inflation started to lower again as a result of covid crisis and thus Fed started with massive quantitative easing again. As from last decade we observe that Fed used quantitative easing further after getting country out of crisis to promote economy reviving. This process went for about 5 years after crisis, so I will assume that after covid crisis rounds of quantitative easing will continue. If the inflation reaches below 0% Fed will re-eastablish quantitative easing (purchasing US Treasuries / mortgage backed securities) from private banks. As studies suggest, QE is strongly correlated to rise in stock prices (I expect this trend will not be applicable after I tweak rate of lending providen by private banks), however QE is of course not the only variable influencing stock prices. As when Fed balance was increasing, prices of stocks always increased as well, but when Fed stopped purchasing and started to slowly decrease its balance, stock prices were still increasing (at that time it was due to Donald Trump elections and his policy of tax reliefs and domestic production promotion). These factors I will also add into my simulation. Each year will represent one round in the simulation, there will be also probability of 1:100 that something unexpected happens and pulls economy into recession. | ||

| + | |||

| + | Before QE the valuation of US equity market was about 12 trillion dollars. Now it is around 50 trillion dollars [https://siblisresearch.com/data/us-stock-market-value/]. For purpose of this simulation I assume that 5% of richest people own 40% of this market, what is currently 20 323 billion dollars. This is also my target group for investigation. I create group of 1000 stock owners, each of them will own 20.3 billions dollars. I will use them when for appreciating or depreciating their shares, as they probably own shares of different companies and thus different shares can follow different trends. | ||

==Variables== | ==Variables== | ||

| − | |||

'''Global variables''' | '''Global variables''' | ||

| − | Inflation - | + | Inflation - starts at 1.2%, what is official number given by https://www.usinflationcalculator.com/inflation/historical-inflation-rates/. |

| − | + | Interest rates (short-term, fed-fund) - starts at 0.25%, taken from https://tradingeconomics.com/united-states/interest-rate | |

| − | + | Time after crisis - this variable will hold the information about how much time after appearance of crisis passed, if it is more than 5 years Fed will keep its reserves, slowly declining it, buying new assests only after old ones expire. When an crisis occur the number will be minimized to 0 (I will assume that crisis will appear either after some unexpected news, when applying QE because of low inflation it won't be done in 5 year interval but rather until inflation is up at about 3% again). Variable starts at 0, because 2020 is the start of pandemic crisis. | |

'''Agents''' | '''Agents''' | ||

| − | ''Central Bank'' | + | ''Central Bank / FED'' |

| + | |||

| + | Balance - Initial state 7.1 trillion dollars. I don't actually care for asset balance on FED's accounts (but I use it so that I can obtain also infor about estimated banks asset balance in 10 years), I need annual change to be able to predict stock prices change. As studies shown stocks prices changes are dependend on Fed policy, but there also other external factors that influence its development (in USA it was Donald Trump's strategy towards domestic producers for example). On the other hand studies show that when Fed's reserves were raising, stock were always raising and when QE stopped stock prices either stopped or raised or slumped a little bit. So I will assume that there is only 1:500 probability that stock don't raise, when Fed applies QE, but 1:10 stock prices don't follow, when Fed stopps the QE actions. Based on annual change in Fed reserves stock prices will follow with normal distribution with mean same as QE change and std 10. | ||

| + | |||

''Banks'' | ''Banks'' | ||

''Richest Stock Owners'' | ''Richest Stock Owners'' | ||

| + | |||

| + | ==1st Round== | ||

| + | |||

| + | In the first round I use only two types of agents, central bank and stock owners. For simplicity I give same wealth to each of 1000 stock owners. I then simulate Fed actions, in case of new crisis they will do massive QE, in case we are in post-crisis area (1-5 years after crisis), Fed applies QE in smaller amounts than right after crisis, but still in significant rate. Then Fed needs to re-establish QE, if inflation is at or below 0%, but also in smaller power. Otherwise Fed will keep their current reserves rate or gently decrease the rate. Inflation and interest rates react to this change. In case of QE inflation rises (inflation rises weakly due to poor bank lending, cca 4-12% of received capital), but if QE this year doesn't conduct QE, inflation lowers rather more (this observation I got from comparing QE activities in the last decade to inflation changes). Also when QE is present I always assume that interest rates are at 0, or closely to zero. Lastly stock prizes react. In case of Fed reserves rising, there is very small probability (1:500), that stock prizes don't follow, otherwise if QE stagnates, there is 1:10 probability that stock prices won't follow. (There are many reasons for this, as QE is not the only factor, that influences stock prices, apparently it is major factor when QE is present, probably because most of new created money goes into stock market and acts there as inflation in economy, thus rising prices. Other way how we can explain is, that when QE is present, loans are very cheap for companies also and so they can finance dividends using loans, because of almost zero interest rates, thus become more popular than other ways of investment and thus there is higher demand for them. On the other side if QE is not present, stock prices are influenced by other factors, such as US governemnt actions, situation in China as there are many investors to US stock market etc.). | ||

| + | |||

| + | [[File:one.png|500px|thumb|right]] [[File:two.png|500px|thumb|left]] | ||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | During simulation on the right I observed another crisis, stock owners wealth resulted in 61 800 billion dollars, Fed reserved reached 20 trillion dollars. When there was not another crisis than pandemic crisis for the next decade, the growth of both stock prices and Fed reserves was not that significant. Stock prices reached 47 000 billion dollars and Fed reserves slightly below 20 trillion dollars. We can also see that stock prices stagnated for about 3 years. | ||

| + | |||

| + | Code: [[File:QE_simulation_1st.nlogo]] | ||

| + | |||

| + | ==2nd Round== | ||

| + | |||

| + | For the second round I established agent group banks, which represent private banks, I gave them variable called propensity to loans. They would make loan in rate of 0.9 normal distribution with std 0.1, which means that almost all of new money will go straight into real economy. I had to remove the function which calculates stock prices according to QE policy, as studies find that it is most likely the fact that currently banks don't lend the most of money they get, why stock prices are highly correlated to QE policy. Now I won't investigate stock prices development, as in this case it will mostly influenced by factors, which are out of scope of this simulation. I also assume, that Fed still wants to keep interest rates low to create "debtor favourable enviroment". Now banks will affect inflation according to how much they lend. Rate how certain amount of new money in economy influences inflation rate I calculated when I compared how it affected inflation rate in the last decade. I know that now banks lend from 8 to 12% and so I can calculate how they will afect inflation rate when giving another percentage of new money into flowing into economy given yearly change of Fed reserves. | ||

| + | |||

| + | [[File: three.png|500px|left|thumb]] | ||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | In the second round it did not matter how many times I ran the simulation, the results were repeatedly very similiar. If I suppose that it is more important to deal with crisis and its consequences than to keep inflation down, I always ended up in high inflation rate (aroun 8 - 10%), what should indicate for Fed to restrain money from economy, however economy wasn't recovered yet. So I found myself in a situation, when I could not find the right solution. After this simulation I have to admit, that eventhough almost all of the money went into economy it was at expense of high inflation. As I suppose there is 5 years recovery period from recession, if I simulate shorter period of time inflation would not go so up, but there is no empirical evidence that economy is able to recovery in shorter period if all money go into economy. And even if I set recovery time to 2 years after crisis appears, inflation still goes to 5%. | ||

| + | |||

| + | Code:[[File: 2ND-Round.nlogo]] | ||

| + | |||

| + | =Conclusion= | ||

| + | |||

| + | In the first round of simulations I focused on stock prices and did not used private banks as agents, because I found exact numbers at what rate private banks are now lending new money and because random distribution between 8 and 12% would not make significant difference in results. I focused on stock prices and found out that if situation continues in current way, most likely Fed reserves will grow along with stocks valuations. However it is critical to mention that because of this stock market overheating, prices growth does not reflect actual companies growth in terms of revenue, production growth etc. However QE is considered a way how to get out of recession, it is very possible that it actually generates another bubble for another recession. | ||

| + | |||

| + | In the second round I used private banks and gave them right to decide to some extent how much they want to give to people/companies in form of loans, here I do not think it is appropriate to investigate stock prices as there are many external factors, which will have more power than QE. And under these circumstances there are no empirical evidences, which could help me simulate the future. | ||

| + | |||

| + | After investigating types of stock owners I found out that these richest stock owners are not traders and seek different things in stocks than dividents and trading, thus they do not participate on trades and don't normally switch to stocks of another companies, therefore I did not use them to decide whether to establish new companies etc. As that would be very uncommon because they focus on companies they often own majority of and there are no data which support their pendling on the equity market. | ||

| + | |||

| + | To sum up my study, based on empirical research and current situation, it doesn't look like QE is sustainable solution for solving recessions, as it can lead to another ones. Overvaluating stock prices can be dangerous as dividend don't have to reflect their prices and thus lead to stock prices fall at some point. Also increasing in spending is mostly done by richest households and by companies which shares grow in price. This approach lacks some mechanism which will drive reserves back to its initial state, rising of inflation through QE is very gentle and it bounces back very quickly. | ||

| + | |||

| + | =References= | ||

| + | |||

| + | http://web.b.ebscohost.com/ehost/pdfviewer/pdfviewer?vid=0&sid=b0ab3804-b496-4672-85d2-6fc1a1f1caf8%40sessionmgr101 | ||

| + | |||

| + | http://web.b.ebscohost.com/ehost/pdfviewer/pdfviewer?vid=0&sid=ed7f3ec8-7c2b-4a07-8f7c-6cc54d92e27c%40pdc-v-sessmgr01 | ||

| + | |||

| + | https://search.proquest.com/docview/1039275454/C82BA7C8A9474B3FPQ/1?accountid=17203 | ||

| + | |||

| + | https://www.thebalance.com/what-is-quantitative-easing-definition-and-explanation-3305881 | ||

| + | |||

| + | https://positivemoney.org/how-money-works/advanced/how-quantitative-easing-works/ | ||

Latest revision as of 22:04, 20 January 2021

Introduction

After global economic crisis in 2007-2009 traditional approaches for stimulating economy growth failed. As a consequence of this a new experimental approach was established, called Quantitative easing. A lot of people think that it is just 'printing money' and putting it into economy. But this is wrong and very narrow-minded. In fact, the central bank of particular country buys financial assets (mostly governement bonds and mortgage backed securities, in case of US bonds are US Treasuries, of different kinds and maturities, here we can find one difference from traditional expansionary policy, which aims on federal funds rates) from banks in exchange for new money. The thought behind quantitative easing is also pretty straightforward, however numbers say that it ceases to work. The first weakness of it is that the money is not put straight into economy (for example through government spending), but it is given to banks. Now when we are in low interest rates situation, it is not very rentable for banks to lend money to people, as with low interest rates and present inflation, they in fact get less value than they initially borrowed. So they often go and buy bonds and stocks themselves and thus overheat their prizes. And new money don't get into economy and so the growth of GDP is not promoted in a way, that it was thought. As 40% of stock market is owned by 5% of richest people in the world, it creates unequal distribution of wealth among population. Rich people get richer and poor people get even more poor and promotion of GDP growth stagnates. For example in the UK after quantitative easing of 375 billion pounds led to 1.2-2% growth of its domestic GDP, what is in numbers 23-28 bn pounds. So we can see how highly ineffective this is.

Model

For this simulation I will use US economy enviroment. In the second round of simulation, when banks will lend approximately 90% of new money, I will observe inflation rate variable, as it is suggested, that we did not face high level inflation (or maybe hyper-inflation) because banks did not lend majority of money they got. If they would have lend, it would be expected, that inflation would be much higher, as market demand for goods and services would be much higher and money supply would be also very high. When I simulate behavior of stock owner, I refer to those owners, who do not trade very often and speculate on the stock markets. I refer to those, who mostly have bigger share in companies and are somehow involved in companies and tend to hold their stocks in long term.

I start in year 2020. We can observe that quantitative easing takes place when interest rates reaches almost 0, but inflation is still very low, and there is threat of economy going into deflation spiral. After global crisis which ended in 2009, Fed used open market operations to lower interest rates, however it did not promote consumption and production enough to get US out of crisis (possibly because americans were already indebted enough and did not want to take new loans), this year there was also deflation of 0.36%. Fed then established quantitative easing, in order to promote spending and get USA out of deflation and out of crisis. As of 2020, inflation started to lower again as a result of covid crisis and thus Fed started with massive quantitative easing again. As from last decade we observe that Fed used quantitative easing further after getting country out of crisis to promote economy reviving. This process went for about 5 years after crisis, so I will assume that after covid crisis rounds of quantitative easing will continue. If the inflation reaches below 0% Fed will re-eastablish quantitative easing (purchasing US Treasuries / mortgage backed securities) from private banks. As studies suggest, QE is strongly correlated to rise in stock prices (I expect this trend will not be applicable after I tweak rate of lending providen by private banks), however QE is of course not the only variable influencing stock prices. As when Fed balance was increasing, prices of stocks always increased as well, but when Fed stopped purchasing and started to slowly decrease its balance, stock prices were still increasing (at that time it was due to Donald Trump elections and his policy of tax reliefs and domestic production promotion). These factors I will also add into my simulation. Each year will represent one round in the simulation, there will be also probability of 1:100 that something unexpected happens and pulls economy into recession.

Before QE the valuation of US equity market was about 12 trillion dollars. Now it is around 50 trillion dollars [1]. For purpose of this simulation I assume that 5% of richest people own 40% of this market, what is currently 20 323 billion dollars. This is also my target group for investigation. I create group of 1000 stock owners, each of them will own 20.3 billions dollars. I will use them when for appreciating or depreciating their shares, as they probably own shares of different companies and thus different shares can follow different trends.

Variables

Global variables

Inflation - starts at 1.2%, what is official number given by https://www.usinflationcalculator.com/inflation/historical-inflation-rates/.

Interest rates (short-term, fed-fund) - starts at 0.25%, taken from https://tradingeconomics.com/united-states/interest-rate

Time after crisis - this variable will hold the information about how much time after appearance of crisis passed, if it is more than 5 years Fed will keep its reserves, slowly declining it, buying new assests only after old ones expire. When an crisis occur the number will be minimized to 0 (I will assume that crisis will appear either after some unexpected news, when applying QE because of low inflation it won't be done in 5 year interval but rather until inflation is up at about 3% again). Variable starts at 0, because 2020 is the start of pandemic crisis.

Agents

Central Bank / FED

Balance - Initial state 7.1 trillion dollars. I don't actually care for asset balance on FED's accounts (but I use it so that I can obtain also infor about estimated banks asset balance in 10 years), I need annual change to be able to predict stock prices change. As studies shown stocks prices changes are dependend on Fed policy, but there also other external factors that influence its development (in USA it was Donald Trump's strategy towards domestic producers for example). On the other hand studies show that when Fed's reserves were raising, stock were always raising and when QE stopped stock prices either stopped or raised or slumped a little bit. So I will assume that there is only 1:500 probability that stock don't raise, when Fed applies QE, but 1:10 stock prices don't follow, when Fed stopps the QE actions. Based on annual change in Fed reserves stock prices will follow with normal distribution with mean same as QE change and std 10.

Banks

Richest Stock Owners

1st Round

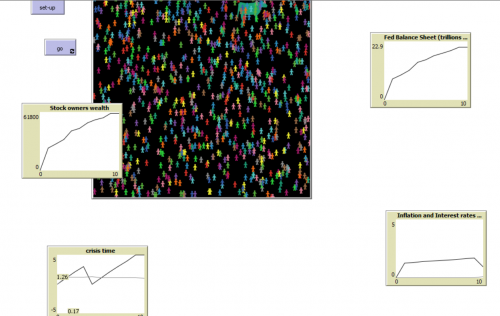

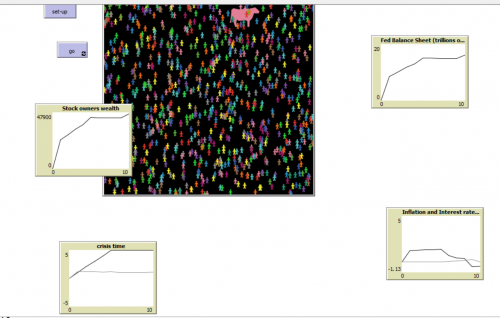

In the first round I use only two types of agents, central bank and stock owners. For simplicity I give same wealth to each of 1000 stock owners. I then simulate Fed actions, in case of new crisis they will do massive QE, in case we are in post-crisis area (1-5 years after crisis), Fed applies QE in smaller amounts than right after crisis, but still in significant rate. Then Fed needs to re-establish QE, if inflation is at or below 0%, but also in smaller power. Otherwise Fed will keep their current reserves rate or gently decrease the rate. Inflation and interest rates react to this change. In case of QE inflation rises (inflation rises weakly due to poor bank lending, cca 4-12% of received capital), but if QE this year doesn't conduct QE, inflation lowers rather more (this observation I got from comparing QE activities in the last decade to inflation changes). Also when QE is present I always assume that interest rates are at 0, or closely to zero. Lastly stock prizes react. In case of Fed reserves rising, there is very small probability (1:500), that stock prizes don't follow, otherwise if QE stagnates, there is 1:10 probability that stock prices won't follow. (There are many reasons for this, as QE is not the only factor, that influences stock prices, apparently it is major factor when QE is present, probably because most of new created money goes into stock market and acts there as inflation in economy, thus rising prices. Other way how we can explain is, that when QE is present, loans are very cheap for companies also and so they can finance dividends using loans, because of almost zero interest rates, thus become more popular than other ways of investment and thus there is higher demand for them. On the other side if QE is not present, stock prices are influenced by other factors, such as US governemnt actions, situation in China as there are many investors to US stock market etc.).

During simulation on the right I observed another crisis, stock owners wealth resulted in 61 800 billion dollars, Fed reserved reached 20 trillion dollars. When there was not another crisis than pandemic crisis for the next decade, the growth of both stock prices and Fed reserves was not that significant. Stock prices reached 47 000 billion dollars and Fed reserves slightly below 20 trillion dollars. We can also see that stock prices stagnated for about 3 years.

Code: File:QE simulation 1st.nlogo

2nd Round

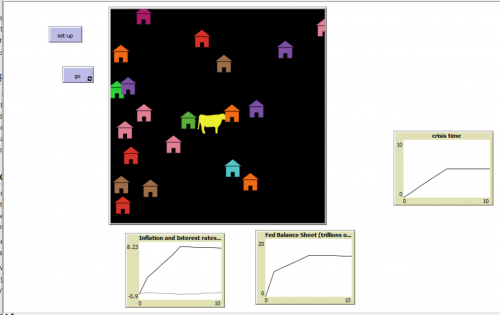

For the second round I established agent group banks, which represent private banks, I gave them variable called propensity to loans. They would make loan in rate of 0.9 normal distribution with std 0.1, which means that almost all of new money will go straight into real economy. I had to remove the function which calculates stock prices according to QE policy, as studies find that it is most likely the fact that currently banks don't lend the most of money they get, why stock prices are highly correlated to QE policy. Now I won't investigate stock prices development, as in this case it will mostly influenced by factors, which are out of scope of this simulation. I also assume, that Fed still wants to keep interest rates low to create "debtor favourable enviroment". Now banks will affect inflation according to how much they lend. Rate how certain amount of new money in economy influences inflation rate I calculated when I compared how it affected inflation rate in the last decade. I know that now banks lend from 8 to 12% and so I can calculate how they will afect inflation rate when giving another percentage of new money into flowing into economy given yearly change of Fed reserves.

In the second round it did not matter how many times I ran the simulation, the results were repeatedly very similiar. If I suppose that it is more important to deal with crisis and its consequences than to keep inflation down, I always ended up in high inflation rate (aroun 8 - 10%), what should indicate for Fed to restrain money from economy, however economy wasn't recovered yet. So I found myself in a situation, when I could not find the right solution. After this simulation I have to admit, that eventhough almost all of the money went into economy it was at expense of high inflation. As I suppose there is 5 years recovery period from recession, if I simulate shorter period of time inflation would not go so up, but there is no empirical evidence that economy is able to recovery in shorter period if all money go into economy. And even if I set recovery time to 2 years after crisis appears, inflation still goes to 5%.

Code:File:2ND-Round.nlogo

Conclusion

In the first round of simulations I focused on stock prices and did not used private banks as agents, because I found exact numbers at what rate private banks are now lending new money and because random distribution between 8 and 12% would not make significant difference in results. I focused on stock prices and found out that if situation continues in current way, most likely Fed reserves will grow along with stocks valuations. However it is critical to mention that because of this stock market overheating, prices growth does not reflect actual companies growth in terms of revenue, production growth etc. However QE is considered a way how to get out of recession, it is very possible that it actually generates another bubble for another recession.

In the second round I used private banks and gave them right to decide to some extent how much they want to give to people/companies in form of loans, here I do not think it is appropriate to investigate stock prices as there are many external factors, which will have more power than QE. And under these circumstances there are no empirical evidences, which could help me simulate the future.

After investigating types of stock owners I found out that these richest stock owners are not traders and seek different things in stocks than dividents and trading, thus they do not participate on trades and don't normally switch to stocks of another companies, therefore I did not use them to decide whether to establish new companies etc. As that would be very uncommon because they focus on companies they often own majority of and there are no data which support their pendling on the equity market.

To sum up my study, based on empirical research and current situation, it doesn't look like QE is sustainable solution for solving recessions, as it can lead to another ones. Overvaluating stock prices can be dangerous as dividend don't have to reflect their prices and thus lead to stock prices fall at some point. Also increasing in spending is mostly done by richest households and by companies which shares grow in price. This approach lacks some mechanism which will drive reserves back to its initial state, rising of inflation through QE is very gentle and it bounces back very quickly.

References

https://search.proquest.com/docview/1039275454/C82BA7C8A9474B3FPQ/1?accountid=17203

https://www.thebalance.com/what-is-quantitative-easing-definition-and-explanation-3305881

https://positivemoney.org/how-money-works/advanced/how-quantitative-easing-works/